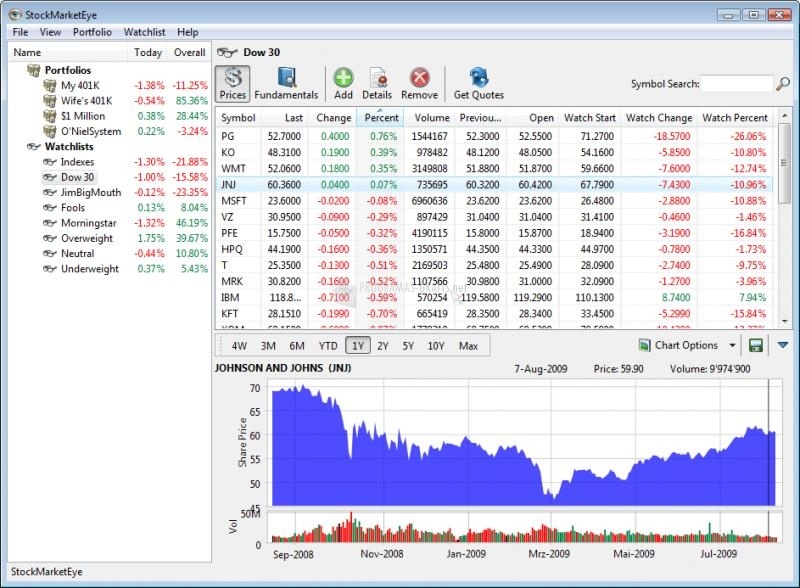

StockMarketEye makes it easy to keep track of multiple investment portfolios and monitor the markets to effectively manage your investments. Data is stored locally on your computer, but can be shared between users with our integrated on-line sync service. StockMarketEye is available on Windows, Mac, Linux, Android and iOS. StockMarketEye 5.4.2. Add to watchlist send us an update. 9 screenshots: runs on: Windows 10 32/64 bit. Windows 8 32/64 bit. Windows 7 32/64 bit. StockMarketEye is a desktop based portfolio tracker and stock analyzer. The software can create watch lists of stocks and indices to track over time for changes in prices and match to price targets. StockMarketEye is an easy to use investment portfolio management software and stop watcher that helps you to keep an eye on your investments and the markets. Track the performance of your retirement account and some other investments with portfolios.

- Portfolio Tracking

- Ease of Use

- Research and Analysis Tools

- Value

Summary

Long-term investors this one is for you! StockMarketEye is a portfolio management software that inclines itself towards long-term investors. With a variety of features, StockMarketEye has peaked some interest. Should you be interested in StockMarketEye? Read our review to decide for yourself.

Review Contents[show]

- StockMarketEye Features

- What Type of Trader is StockMarketEye Best for?

Introduction To StockMarketEye

StockMarketEye is a portfolio management software geared more towards long-term investors than active traders. While the interface of StockMarketEye is somewhat outdated, the software is nonetheless intuitive to use and makes it simple to track the performance of multiple portfolios through time. The software offers some basic charting features, but is relatively limited in scope and is matched by the portfolio accounting tools offered by most brokerages.

StockMarketEye Pricing Options

StockMarketEye is a desktop software available for a one-time $49.95 fee for the v4 release, or $99.95 for the soon-to-be-released v5. Users can also purchase v4 and upgrade to v5 when it becomes available for a total of $99.95. Users get free minor updates, but must pay for major updates that are released every 2-3 years.

StockMarketEye also offers a 30-day free trial.

StockMarketEye Features

Portfolio Tracking

The primary function of StockMarketEye is to track the performance of multiple long-term investment portfolios. It is straightforward to create a new portfolio in the software, and to manually enter stock purchases or to import data from a brokerage. StockMarketEye is capable of handling stocks, ETFs, mutual funds, options, and forex trades, and can account for commissions, dividends, and all other relevant collateral transactions. Stronghold 2 editor.

Once a portfolio has been created, users can see the current market performance of every asset in their portfolio. Data can be updated in real time or on-demand according to user preferences. A nice advantage is that StockMarketEye also imports fundamental data for each stock, which can be quickly compared across stocks in a portfolio.

All of this data is then turned into reports that show the performance of a single portfolio over time (similar to MarketRiders), or all of a user’s portfolios, compared to major indices. While these reports are convenient, it is difficult to see advantages to them over the reporting formats offered for free with most brokerage accounts. Instead, StockMarketEye is primarily useful for tracking multiple portfolios held across brokerages in a single place or for tracking portfolios for which the assets are held across multiple brokerages.

Alerts

One of the useful features of StockMarketEye for investors who take a more active role in managing their portfolios is alerts. Alerts are relatively simple, especially when compared to platforms designed for active traders such as ThinkorSwim. Alerts can only be based on a single criterion, and most available criteria are related to price or gain/loss rather than to any technical indicators.

Charting

StockMarketEye does include some basic charting, although like the rest of the platform these charts are designed to complement fundamentals rather than highlight technical indicators. You won’t find the same charting tools you will find in robust platforms like TradingView and TC2000.

The shortest chart period available is one day and the selection of technical analyses that can be applied to charts is limited to the most popular indicators. One nice feature of the StockMarketEye charts is that they make it extremely simple to compare two stocks, ETFs, mutual funds, or indices over time. However, it is again difficult to identify any unique features of these charts that differentiate them from what can be obtained from a brokerage or a free charting software.

Mobile Apps

A modern advantage to StockMarketEye is that the software is available as a mobile app for both Android and iOS devices. The app layout is relatively streamlined and makes it easy to see the performance of assets in a portfolio at a glance, but lacks the advanced portfolio organization tools of the desktop software. Note that the app costs $1.99 on the Apple App Store and $2.00 on the Google Play Store.

Layout and Customization

The real reason to use StockMarketEye is that it allows users to finely tune their organization of their portfolios. Investors can create new portfolios with the click of a menu button, as well as organize portfolios into groups for different purposes. Within the navigation pane on the left of the platform, portfolios can also be dragged-and-dropped to re-order them and move them into different groups.

The interface of the StockMarketEye software is somewhat reminiscent of an old version of Microsoft Excel (similar to Market XLS)(similar to Market XLS). For example, all asset data is tabulated in a grid that resembles Excel. However, while this interface appears outdated, it is extremely simple to navigate and does not contain unnecessary menus. It also makes exporting data simple, since what you see in StockMarketEye is almost exactly what you’ll get if you choose to export a CSV file.

One thing to watch out for is that StockMarketEye offers both portfolios and watchlists. Although the two asset lists are fundamentally the same and almost entirely identical in terms of the options available for managing them within the software, StockMarketEye strictly delineates them. Therefore, there are near-identical menus for portfolios and watchlists.

Compatible Brokerages

It is straightforward to link StockMarketEye to accounts at most major US brokerages. However, keep in mind that this account link can only be used to import transaction data when creating a portfolio, and cannot be used to update transactions or to buy and sell holdings.

StockMarketEye Platform Differentiators

StockMarketEye is a relatively simplistic portfolio tracking software that does not offer much in the way of unique features. The main advantage to StockMarketEye is that it can import data from a number of different brokerages as well as easily handle manual transactions. This makes it possible to track the performance of portfolios that have been purchased across multiple brokerages or that involve multiple types of assets. The ease with which users can export data to Excel – given the Excel-like interface of the software – also makes it simple to extend the usability of portfolio performance data.

What Type of Trader is StockMarketEye Best for?

StockMarketEye is best for long-term investors who have multiple portfolios with different goals or who have holdings across multiple different brokerages. The platform does feature basic charts, fundamental data, and price-based alerts for investors who want to take a more active role in managing their holdings. However, it does not offer the advanced research tools that more heavily involved traders would want, nor the analyst research and recommendations that many brokerages provide.

Pros

- Easily import transaction data from brokerages

- Organize portfolios and watchlists into groups with drag-and-drop functionality

- Basic charts, fundamental information, and price-based alerts

- Excel-style interface makes exporting data simple

- Mobile apps available for iOS and Android

Cons

- Few unique features beyond what most brokerages provide

- Cannot be used to buy and sell holdings from brokerage accounts

| ITQlick Score: | 55/100 |

|---|---|

| ITQlick Rating: | (4.5/5) |

| Pricing: | 4.2/10 - average cost |

| Category: | Inventory Management ->Stockmarketeye |

| Ranking: | Ranked 198 out of 222 Inventory Management systems |

| Company: | Transparentech Llc |

| Pricing: | starts at $100 per user/year |

| Typical customers: | Start up, Small business, Medium business, Large business |

| Platforms: | Desktop, Cloud |

| Links: | Stockmarketeye pricing, Stockmarketeye alternatives |

Shlomi Lavi / updated: Aug 07, 2019

We publish unbiased reviews, our opinions are our own and are not influenced by payments from advertisers. Learn more in our advertiser disclosure.

What is Stockmarketeye?

Average Rating

The rating of Stockmarketeye is 4.5 stars out of 5 and the total score is 55 out of 100. The ratings are based on our unbiased experts. Learn more in our rating methodology page

Typical Customers

The typical customers include the following business size: Start up, Small business, Medium business, Large business

Stockmarketeye's list of categories:

Stockmarketeye's list of features:

Stockmarketeye Vs. Alternatives

Stockmarketeye Review

Stockmarketeye Review

Author

Shlomi Lavi

Shlomi holds a Bachelor of Science (B.Sc.) in Information System Engineering from Ben Gurion University in Israel. Shlomi brings 15 years of global IT and IS management experience as a consultant, and implementation expert for small, medium and large size (global) companies.